How to Pay Yourself From Your S Corp: What is a Reasonable Salary?

Disclaimer: while we hope to provide as accurate results as possible any information here should not be considered tax or financial advice. You should speak with a licensed CPA about your unique situation for a more accurate valuation of your tax obligation and any potential savings.

So you’ve discovered that tax saving wonder known as the S Corp. You’re ready to start kicking the tires by learning what this “Reasonable Salary” thing is all about. Let’s discuss what it means, why it matters, and the best way to find yours.

A reasonable salary for an S Corporation's shareholder-employee is the part of their compensation that must be treated as employee wages. The IRS requires you to be paid an appropriate wage for the services you provide your corporation because when you get paid via payroll, both the employer and employee pay payroll taxes. These payroll taxes provide needed funding for Social Security and Medicare. It’s best to work with an experienced tax professional to set your optimal reasonable salary, but this article will be a great primer to get acquainted with what a reasonable salary is.

The tax savings of S Corps come from the fact that owners can pay themselves through profit distributions, and not just salary. Ordinarily, your salary pays full Self-Employment taxes (around 15%), however, your profit distributions can legally avoid them entirely! Even though your reasonable salary will have to pay that expensive 15% tax, your other compensation will enjoy major tax savings. Many legal battles, almost always won by the IRS, say that if you work in your S Corp, you need a reasonable salary. It's a non-negotiable, capeesh!

What’s a Good Reasonable Salary Range?

It’s tempting to think: it’s just a number right? Can’t I just hop on PayScale and search for salaries that sound like what I do? Here’s the reality: your reasonable salary is one of the most important and scrutinized numbers the IRS looks at. They will consider a laundry list of factors that can impact your salary. So we’ll cover the right way and wrong way to tackle these requirements.

Hopefully, the IRS never asks you why your salary is reasonable, however, if they do, they’re going to expect more than just dredging up their crusty industry statistics from 2013. If you're curious, 2013 was the last year the IRS published their data about S Corps. While we’ll be using this research to help guide our salary decision, it’s not a silver bullet.

Alright, so we need to consider all factors the IRS does. This includes your day to day roles, industry’s average, profitability, and more factors we’ll discuss later. Unfortunately, there are many popular “rules” floating around the internet that claim to give you an easy way to calculate your salary. Let’s take a look at a few and why you should think twice before using them!

The S Corp 60/40 Salary Rule

This is where you pay 60% of your business income as your salary and the remaining 40% as a distribution. For example, following this rule, someone earning $80,000 per year would pay themselves a $48,000 salary and a $32,000 profit distribution. Here we find the first reasonable salary pitfall: paying too much in payroll taxes. Take a look at these industry average reasonable salaries from the IRS, which are lower than 60%:

Finance and Insurance - 40% salary

Real Estate - 42% salary

If your business is in these industries it’s likely you left some major money on the table using the 60/40 rule!

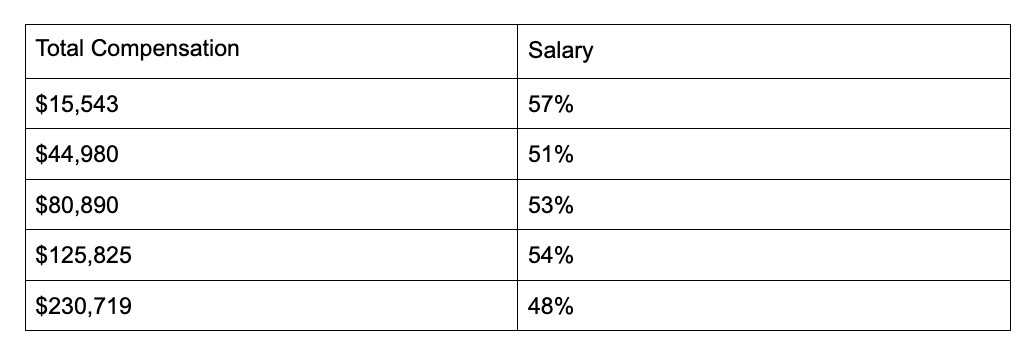

How about using industry averages then? The short answer is no: there are big, highly profitable, S Corps skewing those numbers (average revenue of an S corporation in 2013 was $1,584,133). In addition to industry, your profitability is another important factor that should be considered when choosing a salary. Let’s take a look at these IRS stats for different levels of S Corp profitability:

Basically across all industries, as compensation increases, salaries trend lower. So can you use profitability as a way to set your reasonable salary? Nope, however, it is another important factor to consider. Alright, the 60/40 is busted, let’s take a look at another popular rule.

The S Corp 50/50 Salary Rule

Alright, so we don’t want to leave money on the table. Let’s live a little and drop our salary to 50% of our business income. An example of this rule would be someone earning $60,000 per year evenly paying themselves a $30,000 salary and $30,000 profit distribution. Here we see the second pitfall of S Corp salaries: IRS calling foul play because you aren’t paying yourself enough salary or payroll taxes. To illustrate this point here are some more IRS industry salary stats:

Professional, Scientific - 52% salary

Health Care - 59% salary

If you’re in the healthcare field, it looks suspiciously like you just stiffed the IRS! As we’ll explore, the IRS may not call foul play just because you’re an outlier in your industry, but it will likely raise eyebrows. Alright, alright, I’ll stop harping on why you shouldn’t be relying on simplistic rules. Let’s look at how the pros set a reasonable salary.

Special mention: The ⅓, ⅓, ⅓ rule. Another popular rule where you estimate you’ll spend a third of business revenues on expenses, a third on your salary, and a third on your distribution. Like the other two rules, we are basically just guessing! Very likely we are either overpaying taxes or exposing ourselves to legal risk and penalties. This is ultimately no better than the 60/40 or 50/50 rule. We’ll need to do more in order to back up our salary decision. We need hard data.

How S Corp Salaries are Calculated

Unfortunately, there’s no magical Excel sheet that will spit out your perfect salary. Although, word on the street is the IRS uses special software to sniff out UN-reasonable salaries. However, the IRS was kind enough to publically share the criteria behind what they consider reasonable:

Training and experience

Duties and responsibilities

Time and effort devoted to the business

Dividend history

Payments to non-shareholder employees

Timing and manner of paying bonuses to key people

What comparable businesses pay for similar services

Compensation agreements

The use of a formula to determine compensation

Those are a lot of factors we need to also consider! So how do accountants and CPAs go about answering these tough requirements? They leverage in-depth knowledge of your business, 3rd party research, legal precedent, and mix it with some good old fashioned experience. It’s complicated, so let’s summarize the important parts.

We’ve talked a lot about your job in the business, profitability, and industry averages, however those are just starting points. What makes up your job needs to be broken down into its specific roles. Profitability needs to be contrasted with similar businesses, even to the extent where geography can be a factor. So your roles, profitability, and industry averages are really more like a sketch of the final picture we'll need to paint.

How do we give our projections some legs? Cold hard data; a popular source of data comes from a research company called RC Reports. The reason they’re so popular is for providing compensation data for all the different hats you wear as a business owner. They consider what you would have been paid for all the individual tasks you do. They even include any impact your geographic location can have. It’s a very robust approach that has one major benefit: if the IRS ever comes knocking you have solid documentation to back up your salary choice.

After looking at your roles, industry, and statistics things get a little more nuanced… and depressing. One last factor CPA’s consider is how your business would run if you died. The better your business can operate in the event of your death, the lower you can justify setting your salary. Yay? This is probably the biggest gray area in setting a salary. Having an experienced CPA is crucial if you choose to lower your salary for this reason. They’ll know what proof the IRS needs to see to accept you have a more passive role in your business.

What Should You Do Next

Now you know that overly simplistic rules lead to the two pitfalls in setting a reasonable salary. Overpaying taxes and overexposure to legal risk. Not paying your accountant to find your reasonable salary is the ultimate penny-wise pound-foolish decision you can make for your S Corp.

For example, let’s say your CPA offers to research your optimal reasonable salary for $400. Is it worth it?

Let’s start with the stick: setting your salary with a tax professional keeps you out of trouble with the IRS. That should be enough of a reason right there. However for added effect: if you’ve been found to be setting too low of a salary, the employment and payroll tax penalties can be as much as 100%. Ouch, that $400 fee is starting to sound pretty good already!

Now for the carrot: optimizing your savings. Let’s say you use the misguided 60/40 rule for your Nevada S Corp that’s netting you $60,000 per year. Your tax savings are around $1,500. Instead, let’s get smart and hire a CPA to determine your reasonable salary. If they determine that your salary could have been 50% of your income, that’s an estimated savings of almost $2,500!

Let’s see: you safely added an additional $600 in savings (after your CPA’s fee). Heck yeah, that $400 fee was worth it! Plus you now have some solid documentation ready in case the IRS ever has questions about your salary.

So if you’re getting ready to make your S Corp a reality, skip the napkin math and call a tax professional.

This article was written by Matt Jensen. Matt is a small business owner and tax strategy enthusiast. Currently creating educational content for other small business owners and entrepreneurs.